The Nodeam High Yield Dual Investment

Invest in the Nodeam High Yield Dual Investment to earn high returns as high as 85% APY depending on market conditions, for short tenures of up to 6 months and the opportunity to buy or sell BTC or ETH at better than current price.

Read more details at the Nodeam HYDI Product Fact Sheet

See how these four High Yield Dual Investment products can help you to achieve your goals.

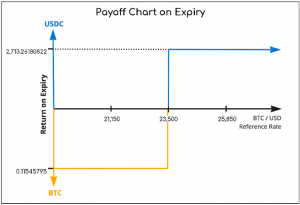

Illustration shows how you can earn yield using USDC and have the opportunity to buy BTC lower with a BTC/USD-Put product

Asset Pair: BTC/USD

Principal: 10,000

APY: 57.99%

Current Price: 30,276.83

Strike Price: 30,000

Tenure: 7 days

Return in Principal: 10,111.21369863 USDC

Return if Converted: BTC 0.33704046

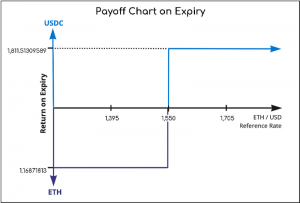

Illustration shows how you can earn yield using USDC and have the opportunity to buy ETH lower with a ETH/USP-P product.

Asset Pair: ETH/USD

Principal: 10,000

APY: 63.48%

Current Price: 1,915.55

Strike Price: 1900

Tenure: 7 days

Return in Principal: 10,121.74246575 USDC

Return if Converted: ETH 5.32723288

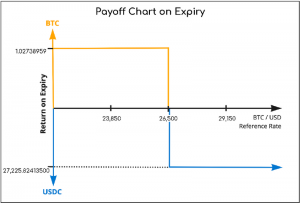

Illustration shows how you can earn yield using BTC and have the opportunity to sell BTC higher with a BTC/USD-C product.

Asset Pair: BTC/USD

Principal: BTC 1.00000000

APY: 34.31%

Current Price: 1,914.54

Strike Price: 31,000

Tenure: 14 days

Return in Principal: BTC 1.01316000

Return if Converted: 31,407.96000000 USDC

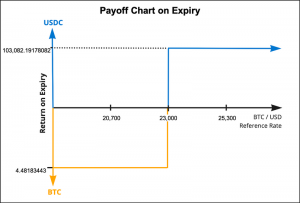

Illustration shows how you can earn yield using ETH and have the opportunity to sell ETH higher with a ETH/USD-C.

Asset Pair: ETH/USD

Principal: ETH 1.00000000

APY: 40.91%

Current Price: 1,915.53

Strike Price: 1,950

Tenure: 14 days

Return in Principal: ETH 1.01569151

Return if Converted: 1,980.5984445 USDC

We Don't Lend Out Your Digital Assets

Nodeam prioritises the security and integrity of your investments above all else. We assure you that we do not engage in practices that involve lending out or staking your digital assets.

Our primary objective is to safeguard your holdings and provide a reliable investment platform for you to manage and invest your assets with peace of mind. We understand the importance of maintaining control and ownership of your investments, and you can trust us to uphold these principles.

Your Digital Assets are Secure

Your digital assets are stored securely with Copper.co, an independent digital asset custody partner serving more than 500 institutional clients including hedge funds, exchanges, banks, and financial institutions globally.

Copper is a SOC2 Type 2 certified company with a registration in Switzerland. Underpinned by multi-award-winning MPC technology, it has been setting the standard for institutional custody of digital assets such as tokens and stablecoins.

Nodeam partners with Copper to provide an institutional grade, end-to-end custody architecture to ensures that our clients digital assets remain in segregated accounts within a secure environment.

Nodeam also leverages on Copper's ClearLoop technology to mitigate counterparty risk across our liquidity partners.

Nodeam

Nodeam was founded by veteran bankers with a combined experience of over a hundred years in the areas of retail banking, treasury, capital markets, and risk management.

Nodeam was formed with the vision of creating a new digital investment asset class and providing investment management solutions for investors who wish to take advantage of the evolving digital asset space.

To be the trusted player in digital assets management.

We provide regulated access to a new digital investment asset class to preserve and grow wealth.

Francis began his career with NatWest Markets as an FX trader in 1996. He has accumulated 25 years in this space and spent time in various multinational banks. He spent the bulk of these years at NatWest Markets and Citibank building new markets and growing existing ones. His product suite includes spot, forwards, futures and other interest rate derivative products.

Francis' foray into cryptocurrencies started in 2019 when the cynic turned believer. He joined a boutique firm and helmed the crypto OTC desk and spearheaded operations which oversaw customer relationship management (CRM) and onboarding process.

Francis received his tertiary education at the University of Iowa. He graduated Magna cum Laude and with Honours in 1995. He was also accorded CFA designation in 1999.

Alvin started his 21-year banking career with Citibank in 1994. He became the Options Trading Head in 2000, and ran a successful trading desk until 2015, before leaving Citibank to pursue his own goals.

Besides trading, he ran the Structured Products Business between 2001 and 2004, and introduced Principal Protected market-linked products to regional retail customers.

Additionally, he led a team that developed and automated FX Options Linked Deposits, enabling hundreds of trades to be transacted live across various business territories. This business became Citibank's flagship product, the Premium Account (popularly known today as Dual Currency Investments in the traditional finance industry).

Alvin also held responsibilities over various options-related booking platforms in the region and was a key player in the development of a risk management matrix for products linked to options. He was one of the key members of the committee to transition to Volker Rule compliance post-Global Financial Crisis.

Alvin believes that each day presents both opportunities and challenges, and he who manages both well will find asymmetrical returns on the risks taken.

Desmond is a two-decade veteran in the banking and financial Industry, that brings with him deep and expansive experience of the financial and investment markets.

Most recently, he was the Managing Director and Head of Group Lifestyle Finance & Digital Ecosystems at OCBC Bank. He was responsible for functional business lines of credit and debit cards, unsecured loans, digital ecosystems, consumer payments and collections. His regional responsibilities cover Malaysia, Indonesia, and Greater China.

He previously served as Executive Vice President at Ta Chong Bank Ltd in Taiwan, and prior to that held several managerial roles for groups across Asia including Citibank Singapore, DBS Bank Ltd and Thai Military Bank (TMB PLC).

On a personal investment front, Desmond owns APLUS Integrated Marketing Limited, a pharmaceutical supplies outfit that specializes in supplying medical personal protective equipment, to hospitals groups and governments, across the Southeast Asian region. He is both a shareholder and board member of Mecotec (Taiwan), an omni-channel medical rehab centre with AI Tech.

On the Digital Asset front, Desmond is advisor and shareholder at VC Plus, Custody Plus, and BCXX Limited.

He also serves as an advisor to Included Learning, a local inclusion-first capacity building social enterprise working in the STEM and AI sector.

Desmond is a proud alumnus of Stanford Graduate School of Business (2014), and holds a Bachelor of Economics & Finance from Curtin University of Technology.

Team Leaders

Jason Low

Head of Technology

Kenneth Tsang

Head of Operations

Ang Kok Wee

Head Of Treasury

Dominic Ying

Head of Brand, Marketing & Communications

Jason has spent the last 18 years honing his craft as a leader and driver in the fields of technology and business development in Schroder & CO (Asia) and NCS Singapore.

He has acquired deep and broad skillsets that enabled him to design innovative bespoke portfolio management solutions, develop a digital asset trading ecosystem, manage business accounts, and deliver projects in finance, wealth management and governmental domains.

He has the expertise to consult, advocate and sell key innovation and technological solutions to meet the changing needs of a dynamic business environment.

Jason holds a Bachelor of Science in Business Information Systems from the University of Porstmouth, United Kingdom.

Kenneth has spent last 20 years of his banking career with Citibank Singapore. He was the Deputy Head of FX and FX Options with Citibank Consumer bank in 2018. During his time with the bank, he has helped to grow the regional consumer businesses, ensure the desk is compliance with the market risk and regulatory requirements. He also oversees system automation enhancement and strengthen the operation processes for the department.

Kenneth earned his undergraduate degree in Toronto, graduating from University of Toronto in 1994 and earning a Bachelor of Arts (Economics) from the school.

Kok Wee embarked on his banking career at Citibank Singapore in 1997, where he played a pivotal role in introducing commoditized FX structured products to the retail market. During his tenure, he significantly contributed to expanding the bank's franchise throughout Asia, with assets under management of USD 5 billion at their peak. He was recognised for successfully integrating the European, Middle East, and Africa (EMEA) businesses into the franchise.

In 2021, leveraging his extensive two-decade trading experience, he ventured into the digital asset space. Most recently, he served as the Chief Revenue Officer at Sparrow Exchange, a Singaporean digital asset company licenced by the Monetary Authority of Singapore (MAS).

Kok Wee graduated with Honours in Finance from Washington State University and holds a Master of Science in Real Estate from the National University of Singapore.

Dominic spent more than 10 years at OCBC Bank Singapore as a team lead in the Group Brand & Communications Division, managing public relations, media relations, communications strategy, brand sponsorship and activation, and events marketing.

He started his career at the Singapore Press Holdings (The New Paper) as a journalist and photojournalist covering stories in the crime, courts, and community beats for five years.

Dominic holds a Bachelor of Arts in Media Studies from Murdoch University, Western Australia.

Have us contact you

Please fill in the required fields for us to contact you if you need help with the establishment of an investment account, or to find out more about products, services, careers, or corporate investment.